Introduction

Perhaps you already know what is presented below, but most don’t, and it’s because most of us don’t know it that the problem has not been properly addressed and fixed.

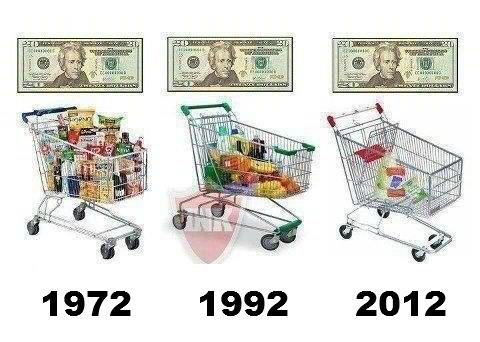

When we go to the gas pump or to the grocery store and have to pay much more today for what we buy than we did last year, or even last week, then what do we think?:

- Gas and groceries are costing a lot more these days, and that seems to be getting worse

- Those gas companies and grocers are jacking up prices to make more profit at our expense

That seems reasonable, right? What other answer could there be?

Well, when we think like that, we are falling into the trap that has been carefully prepared for us and are doing exactly what “they” want us to do and fully expected that we would do because they think that they know us so well. Why do they want us to think like that? Three very good reasons:

- It gives us a false target for our anger

- It keeps us from thinking in the way that we should be thinking

- It keeps us from understanding what is really happening and why

- They can, therefore, keep on doing what they have been doing without fear of consequences

So long as we do as they expect and think like they want us to, the true reason for rising prices and the true culprits behind it remain hidden and safe. If the above represents the wrong way to be thinking, then what is the correct way? Here’s the secret – Instead of thinking that prices are going up, we should be thinking the following:

The purchasing power of our money is going down!

Okay, if that’s true, then how does it happen?

Generally speaking, it happens by the Federal Reserve creating money out of thin air and putting it into circulation. More specifically, it happens most often this way:

- The US Treasury Department creates securities (bonds or whatever) that it wants to sell

- Treasury officials take the securities to the Fed

- The Fed buys the securities

- The Fed pays the Treasury Department by making an electronic deposit to the Treasury’s account with the Fed

So, what’s wrong with that?

What’s wrong is that the money that the Fed put into the account of the US Treasury had not existed before the electronic entry was made and is, therefore NEW MONEY that makes the total money supply greater. Regardless of the fact that the electronic money deposited into the Treasury’s account had not existed just a few moments before, it spends just as well as the greenbacks in your wallet and the electronic money in your own checking account. This new money, in effect, dilutes and debases the existing money supply and reduces the value of every dollar that was already in circulation. It’s sort of like that day that you had fixed a big pot of that soup that you like so much. All day long, you had been looking forward to enjoying it. Then, the country cousins came unannounced to supper, and you had to add another several cups of water to your pot of soup. How did that soup taste?

The result of the monetary dilution is a general rise in prices. Increasing the money supply is known as inflation, and higher prices are its symptom and tangible evidence that inflation has occurred. As Nobel laureate economist Milton Friedman was fond to say, “Inflation is always and everywhere a monetary phenomenon.” If you always remember that, then you will always remember, too, that rising prices are not the problem but the symptom and that the true problem is that our money has been seriously debased. You will understand, also, that we have been robbed just as surely as if someone had held us up at gunpoint.

The ability to create money at will from nothing is made possible by the removal of the link between money (again whether electronic or otherwise) and gold or silver. In a monetary system wherein the money is backed by gold and silver, the relatively finite supply of those precious metals places a powerful limitation upon the ability of the government to inflate. The word, fiat, means, more or less, government decree, so money that has no intrinsic value and therefore has value only because the government decrees that it has, is called “fiat money”. In the USA, our money today is fiat money.

Hopefully, you will now understand, too, why it is that no civilization that has given its government the power to print (electronically or otherwise) fiat money has long survived its regrettable folly.

The dissolving of the link in this country between the money and precious metals has been gradual, but the last vestige of a link was unfortunately removed by President Nixon, who was, incidentally, a Republican. Since then, the United States has been on a money system wherein the money has value by fiat alone, and our precarious financial situation today is sad testimony to the predictable result.

The Fed calls the process described at the beginning of this section, whereby the Fed purchases Treasury securities, “Quantitative Easing”. Why do you suppose they call it that instead of the following more accurate name?:

Theft of the Purchasing Power of Every Single American by Their Government!

Inflation is, in fact, a hidden tax upon every American, yet it is a tax that was never introduced in Congress and was never voted upon by a single representative. More than that, however, it is a tax that (nearly) every politician pretends does not exist, or, even worse, thinks, as recent presidential candidate Rick Santorum stated, that a little (inflation) is necessary and, therefore, good. Anyone who is not a total stranger to truth knows that Inflation in any amount is theft and is, therefore, illegal, illicit, and immoral.

If you like statistics, here are a few for you:

| M11 | M22 | |

| January 5, 2009 | 1,637.7 | 8241.0 |

| September 24, 2012 | 2,359.7 | 10,138.2 |

| % Increase | 44.1 | 23.0 |

Also, according to The Washington Post, in its QE1 and QE2 the Fed pumped $2.1 trillion of new money into circulation, and it is now in the process of implementing QE3.3 As a point of fact, just who do you think is the largest purchaser of Treasury bonds? China? Japan? The correct answer is neither. The largest purchaser of US Treasury bonds is the Federal Reserve.

But wait a minute, you might say, the government tells us that the current annual inflation rate is presently less than 2%! That’s not so bad, is it? Well, that depends upon how you look at it. In one respect, theft is theft, but, for the sake of this discussion, let’s assume that what a reported 2% inflation rate is not is “too bad.” What it is, however, is a total fabrication. Just as the federal government cooks the books on the unemployment rate, which is actually from 14% to 18% and getting worse, so does it also cook the books regarding the reported rate of inflation. How? In many ways, including the following, according to Dick Morris4:

- It excludes the prices of food and energy, including fuel, from the calculation – Where, I ask, have you noticed the worse increase in prices? Yep – food and fuel.

- When the price of one item used in the calculation goes up more than they want to show, they just substitute something else that has not gone up as much.

- It excludes so-called “hedonistic” products – For example, it might use the prices of cars without air conditioning which, in effect, hides increases in the prices due to that part of a car’s cost.

- In averaging the prices of different commodities, it uses a geometric mean instead of an arithmetic mean – Without going into unnecessary detail here, this, again according to Morris, has the effect of (surprise!) understating the rate of price increase.

So, the actual rate of inflation is much higher than that being told to us. Some people say that it is actually a Carteresque 10% or more, but who knows? One thing seems certain, however: with all of the new money that the Fed has pumped into the economy, and with QE3 is still pumping, if the current inflation rate is not already 10% or more, then it is only a matter of time until it is.

Summary

From now on, whenever you go to the gas pump or into any store and see that, due to higher and higher prices, your money is purchasing less and less as the days pass, whether the actual inflation rate is 2% or 10% or more, you will know:

- That a dirty sneaky thief has been plying his loathsome trade

- That you are his victim

- How the theft is happening

- The true identity of the thief

I leave you with the following words of James Madison, the principal author of the greatest political document in the history of the world, The United States Constitution:

Knowledge will forever govern ignorance; and a people who mean to be their own governors must arm themselves with the power which knowledge gives.

But, knowledge unapplied is knowledge wasted, so, hopefully, you will put your new-found, or newly refreshed, knowledge to good use.

If you would like to know more about money and how it might have evolved to its current state, you might take a look at Part 1 of this two part series:

Inflation, Part 1: The Evolution of Money, Both Real Money and Funny Money .

Footnotes:

- 1. http://research.stlouisfed.org/fred2/data/M1.txt

- 2. http://research.stlouisfed.org/fred2/data/M2.txt

- 3. http://www.washingtonpost.com/blogs/ezra-klein/wp/2012/09/13/qe3-what-is…

- 4. http://www.dickmorris.com/how-the-feds-conceal-inflation/

Jere Moore has been blogging about political matters since 2008. His posts include commentary about current news items, conservative opinion pieces, satirical articles, stories that illustrate conservative principles, and posts about history, rights, and economics.